TU IS

I believe last week is going to go down as one of the most important in crypto history. The collapse of FTX (FTT-USD) is likely going to create ripple effects throughout the rest of the crypto market and it could potentially even have an impact on traditional finance. The logical question now is who is next? Over the summer, we saw the collapse of Terra (LUNC-USD) result in a contagion effect that also took out 3 Arrows Capital, Voyager Digital (VGX-USD)(OTCPK:VYGVQ), and Celsius Network (CEL-USD).

The FTX collapse has weighed heavily on the entire crypto industry over the last week. While the bear case for FTX Token is self-evident at this point, one coin that was hit particularly hard because of FTX was Solana (SOL-USD). While there is good reason for that, if Solana’s network metrics were performing better, SOL may have shown better resiliency. Crypto investors are now looking at other centralized custodians and wondering if we may see history repeat. Much of the noise online about the next potential shoe to drop has been popular exchange Crypto.com (CRO-USD). The token has taken a beating because of that speculation.

CRO Daily (TradingView)

On the chart, we can see $0.10 has served as support during this big downturn following the liquidation events from this summer. That support has broken and CRO appears to be entering a freefall as well. There’s actually good reason to wonder if Crypto.com is having problems. We know from recent reporting by Ad Age the company has been scaling back ad-spending and cutting its staff.

In the months that followed, Crypto.com quietly downsized many of the partnership deals intended to garner mainstream attention for the brand, and in some cases the firm has attempted to pull out from these deals altogether, according to details shared by former and current employees at the company who spoke with Ad Age on the condition of anonymity.

This is not a good look but it doesn’t mean the company is going out of business. It could actually be an indication that Crypto.com has been trying to be more responsible with expenses given the broad market declines of the last several months.

Similarities to FTX

Like FTX, Crypto.com is a well-known centralized crypto exchange. Also like FTX, the company has committed a lot of money through its marketing department. Crypto.com owns the naming rights to the arena where the NBA’s Lakers, Clippers, and NHL’s Kings play. This is among other sports sponsorship deals that include FIFA and Formula 1. Just like FTX before, we’re starting to see funds moving out of known Crypto.com wallet addresses. These are just the Ethereum (ETH-USD) addresses associated with Crypto.com:

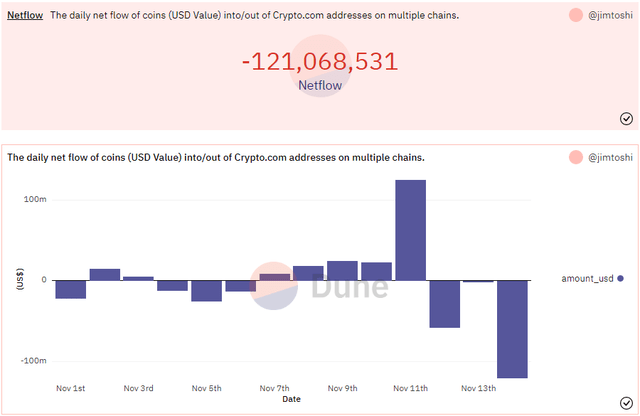

Platform Outflow (Dune Analytics/Jim Toshi)

After a big spike in fund flow on Friday, we’ve seen three consecutive days of outflow and the worst of it is actually within the last 24 hours – with over $121 million coming out of Crypto.com just in the last day. However, while there are some similarities with FTX from both a marketing strategy and asset outflow problem, we are told there are key differences as well.

Differences from FTX?

On one hand it probably isn’t fair to assume Crypto.com is structured as poorly as FTX simply because it’s a crypto business. On the other hand, how many times do market participants need to learn the same lesson on self-custody? Early this morning Crypto.com CEO Kris Marszalek did an AMA and explained how Crypto.com is different from FTX:

We are not a hedge fund. We do not trade customers’ assets. We also kept reserves 1:1 and that’s very true today.

What we don’t know yet is what Crypto.com’s corporate obligations are. Marszalek said in the AMA that we can expect liabilities clarity in the next few weeks and he also said the company doesn’t collateralize the CRO token. I’d say these are generally positive signs for the customers of the Crypto.com platform. But it still does require trust in both Marszalek and the platform itself to justify keeping assets stored there. To its credit, Crypto.com has worked with Nansen to provide a live dashboard of the company’s self-reported crypto wallet addresses. This allows anyone to see the assets the company has in reserve. It is good transparency, but it does raise another question:

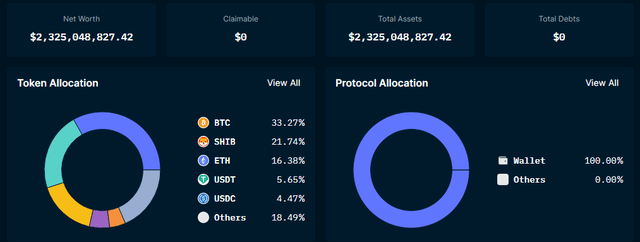

Crypto.com Holdings (Nansen)

A big concern I see on this token allocation is nearly 22% of the company’s $2.3 billion assets in Shiba Inu (SHIB-USD). SHIB is yet another dog-money meme coin that I personally wouldn’t recommend going anywhere near. But if you are bullish SHIB and worried about Crypto.com’s solvency, this revelation could be cause for concern.

Contagion Risk To Shiba Inu?

Even though I don’t personally see a need to have SHIB exposure, there are others who disagree. For them, the crypto.com position in Shiba Inu becomes more interesting. With a $2.3 billion balance sheet and 21.74% exposure to SHIB, Crypto.com’s SHIB position is roughly $500 million – or a little under 10% of SHIB’s fully diluted market valuation according to CoinMarketCap. Crypto.com and its users have a very large ability to move the SHIB price lower if those assets get sold. This isn’t quite as large as Binance’s FTT position as a percent of FTT’s market cap a week ago, but it’s bigger than Alameda Research’s SOL position was.

Alameda Research had a $1.2 billion SOL position while Solana’s fully diluted cap was about $17 billion at the end of June. Since Alameda Research had such a large position in SOL and needed to liquidate assets to defend its FTT position, SOL’s price experienced more than a 60% drawdown over the course of just a few days. In this morning’s AMA, Kris Marszalek said Crypto.com’s SHIB position is so large because that’s what the customers on the platform are buying and the company needs to allocate to that asset accordingly in its reserves so that when customers want their SHIB, the company actually has it.

If we trust Marszalek isn’t acting nefariously, there shouldn’t be as much risk in Crypto.com defaulting on customer obligations if the company truly has a 1:1 reserve ratio even if the run on assets on Crypto.com continues and customers start taking self-custody of their SHIB. Even if Crypto.com does actually have solvency problems like FTX, I don’t necessarily see a Solana-like risk here for Shiba Inu unless Crypto.com starts selling the SHIB without customer permission. But that would be an indication of much more severe problems and I view that outcome as very unlikely despite what we just witnessed last week from a peer.

CRO Utility

I’ve covered CRO before for Seeking Alpha. That coverage was not positive of the token because staking the asset in Crypto.com’s earning ecosystem had become far more expensive than it was previously. Since that article, the rewards have increased slightly on the lower tiered Visa (V) cards but it still isn’t economical to take advantage of that offer in my view. That may be why CRO makes up such a small portion of Crypto.com’s token allocation. Clients aren’t holding it anymore because there isn’t much reason to.

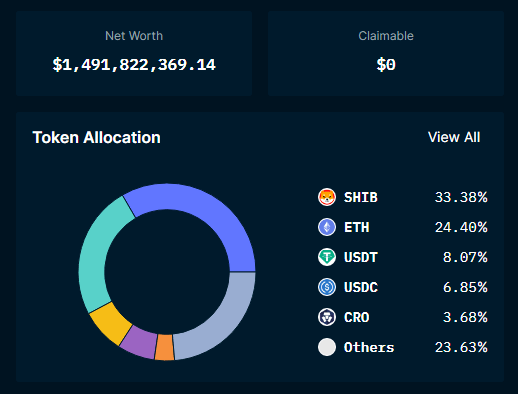

ETH Wallets (Nansen)

Just 3.7%, or $54 million, of the $1.5 billion Ethereum-based assets on crypto.com are CRO token. Even though I don’t see much purpose as an exchange token, CRO is still utilized in the Cronos ecosystem.

CRO TVL (DeFi Llama)

Despite the large declines in the price of the coin, the TVL measured in CRO is actually now at an all-time high after spiking from 6.75 billion CRO to over 10.42 billion CRO in the last 5 days. Still I would exercise a lot of caution before buying the CRO dip. 54%, or $360 million, of the TVL on Cronos is attributable to one protocol: VVS Finance (VVS-USD), an entity that appears to be a classic high-APY, yield farming protocol destined to fall apart.

Summary

If you’re a Crypto.com user, I recommend using it as an on-ramp not as an asset custodian – at least not with a significant portion of your funds. Crypto.com’s token has been taken to the woodshed over the last few days and you could argue the selloff is overdone given the severity of the decline. But I’d caution buying CRO for its potential utility on the Cronos blockchain. With 75% of the blocks coming from just three entities, the blockchain validation is highly centralized and the DeFi footprint looks to be mostly attributable to the kind of risky protocols that Alameda Research was playing with.

While we don’t know what the other side of Crypto.com’s balance sheet looks like, even if the company is solvent I don’t see a big reason to buy CRO. I’m not a fan of SHIB either but I don’t think SHIB will get the same treatment from Crypto.com that SOL got from Alameda Research.