Avalanche [AXAV] recently made it to the list of the top cryptos in terms of total value locked (TVL). The network nabbed the third spot and was only behind BNB and Tron [TRX].

Avalanche Weekly TVL Dashboard

Compared to last week, #Avalanche received a lot of positive news from many projects, and the ecosystem is moving forward every day.

Some highlighted projects:@farm_hedge @KyberNetwork @CIAN_protocol @ZooEcosystem

Detail ??$AVAX #AVAX pic.twitter.com/btuLr5fC6B

— AVAX Daily ? (@AVAXDaily) October 30, 2022

_____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Avalanche [AVAX] for 2023-2024

_____________________________________________________________________________________

Surprisingly, despite making it to the list, DeFiLlama’s data revealed that AVAX’s TVL had been on a constant decline for weeks now. Furthermore, at press time the figure stood at $1.35 billion. AVAX Daily, a Twitter handle that posts updates about the Avalanche ecosystem, also mentioned this episode in its tweet. The network mentioned that although the decrease was not strong, AVAX’s TVL still continued to find a bottom.

Moreover, in the latest edition of AVAX’s weekly digest, it was revealed that over 13.9 billion transactions took place on the Avalanche blockchain in the last seven days. The tweet also mentioned that Avalanche’s total staked amount exceeded 263.2 million AVAX.

Avalanche Subnet Weekly Stats

Total Subnets: 36

Total Blockchains: 28

Total Validators: 1234

Total Stake Amount: 263,273,999 AVAXOverview??#AVAX #Avalanche $AVAX pic.twitter.com/AVgd8kDivW

— AVAX Daily ? (@AVAXDaily) October 30, 2022

A bull market effect?

Like most other cryptos, AVAX also managed to make its investors happy by registering over 18% weekly gains. However, the scenario seemed to have changed a bit as AVAX’s 24-hour performance was not up to the mark.

At press time, AVAX was trading at $18.68 with a market capitalization of $5,573,521,344. Interestingly, a look at AVAX’s metrics provided some clarity on the situation, as they hinted at what was actually going on.

Investors beware

AVAX failed to gain interest from the derivatives market lately as both its Binance and FTX funding rates registered a decline over the last few days.

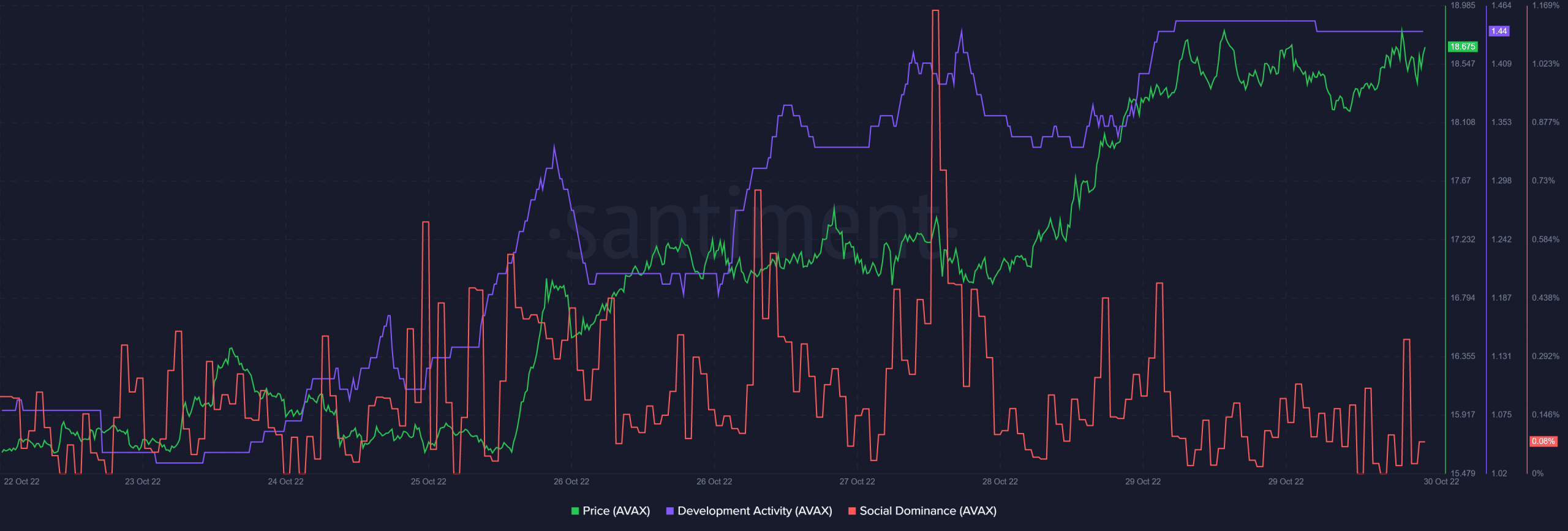

Source: Santiment

Not only this, but AVAX’s social dominance also decreased after marking a spike on 27 October, indicating less popularity of the token in the crypto community. Furthermore, CryptoQuant’s data revealed that AVAX’s Relative Strength Index (RSI) was in an overbought position. This could further increase the chances of a trend reversal.

However, the only thing that was working in AVAX’s favor was its development activity. AVAX’s development activity witnessed a rise over the past few days. This was a good sign because it indicated that developers were working harder to improve the network.

Source: Santiment