Phira Phonruewiangphing

Overview

Litecoin (LTC-USD) was created in 2011. It is actually a Bitcoin (BTC-USD) fork, which means its fundamentals are very similar to those of Bitcoin. Like Bitcoin, Litecoin has a limited supply, and mining rewards halved roughly every 4 years.

The key difference between these two cryptocurrencies is that Litecoin was created to transact faster and more cheaply. This is achieved through faster block production, Segregated Witness, (SegWit), and also by enabling Layer 2 solutions like the Lightning Network, which Bitcoin also uses.

Litecoin has been described by many as the digital silver to Bitcoin’s digital gold. It is also a good and cheap environment to test out applications for Bitcoin.

Litecoin has rallied strongly in anticipation of its halving event and higher adoption, but ultimately, digital silver has no real purpose like there was for physical silver.

The Litecoin Cycle

Most people are familiar with the Bitcoin cycle surrounding the halving events. In the past, bitcoin has tended to rally following the halving event and then entered a bear market in the 2 years prior to the next halving.

Litecoin also has halving events every four years, and we can also see that price tends to react in a certain way in relation to these.

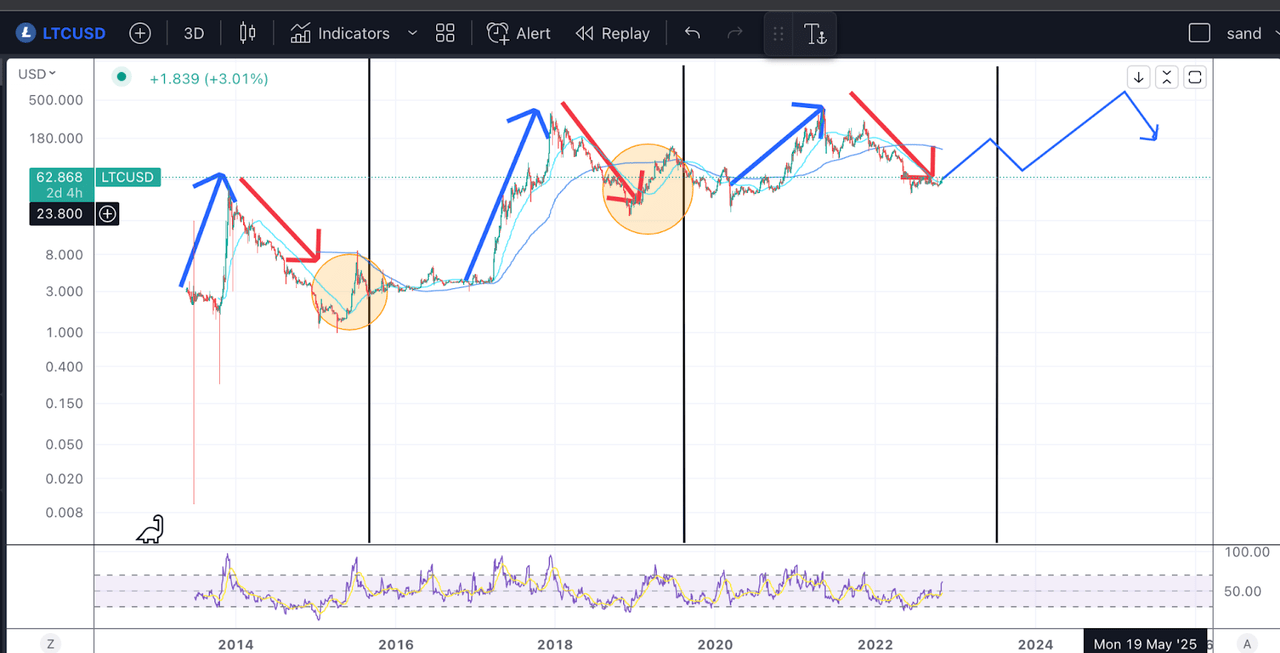

LTC cycle (TradingView)

The black lines above show when each halving cycle has happened in the past. We had one in 2015, 2019, and one is expected in July 2023.

As we can see, Litecoin tends to rally in the months leading up to the halving. Then the price tends to stabilize before entering a lengthier and more substantial bull market. Then, around halfway through the cycle, Litecoin enters a bearish/distribution phase like Bitcoin.

Bitcoin has rallied 25% in the last week, outperforming most other cryptocurrencies. This has led some analysts to point out that the pre-halving rally may have begun.

Bullish Adoption

On top of this cycle analysis, there has also been some positive news for Litecoin, which may have acted as a catalyst to spark this latest rally.

Last week, MoneyGram, one of the largest P2P Payment platforms, announced it would set up a system for its users to buy, store and pay using cryptocurrency. For now, though, this will be limited to Ethereum (ETH-USD), Bitcoin, and Litecoin.

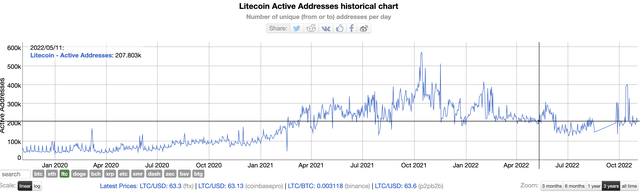

This is great news for Litecoin, and it is not the only good news in recent weeks. If we look at active addresses, we can see that Litecoin’s network has experienced a big spike.

LTC addresses (Bitinfo)

This shows increased interest in LTC and could spark a FOMO-inspired rally in the near term.

With all these factors lining up, it looks like LTC is ready to continue its ascent. But just how far will it go?

Technical Analysis

First, let’s look at Litecoin’s long-term chart:

LTC long-term chart (Author’s work)

Since its 2019 low, Litecoin looks to have completed at least three waves of an expanding diagonal. We can see that the latest low went almost as far down as the 2019 low, but we have respected the bottom trendline. The peak in wave 3 in 2021 stopped just short of the 1.618 ext of wave 1, so I’d say a good target for wave 5 would be the 2 ext, which could take us all the way into the $800 region.

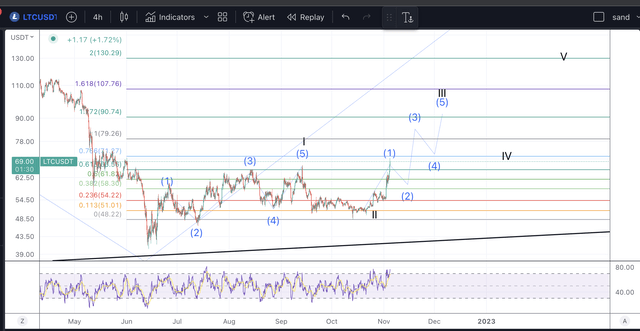

LTC analysis (Author’s work)

On the smaller time frame, we still need to see stronger evidence of a bottom, but for now, we could argue that LTC has formed a diagonal in a wave I, and a wave II in an expanded flat. This means we are now starting wave 3, which makes sense given the impulsive nature of this rally. If that’s the case, then I’d expect us to rally into the 1.618 ext at $107 to complete wave 3, and all the way up to $130 to complete wave V.

This would in itself be part of a larger degree wave 1, which could develop from here to July, giving us that pre-halving rally. Following that, we would have the wave 2 retracement, which also makes sense given how LTC tends to sell off and stabilize after the halving.

Risks

With all this said, and though I do see LTC rallying in the coming months, there are no real fundamental advantages to Litecoin, in my opinion, which is why I don’t own it.

In the past, silver was necessary because gold was too precious for small trades. Even a small gold coin commanded significant value. Silver was necessary to carry out these smaller transactions. However, this is not an issue with Bitcoin since it is infinitely divisible.

The other “advantage” of Litecoin is supposed to be transaction speed. But instant Bitcoin transactions are already available through the lightning network. So what does Litecoin have left to offer?

It can still be a neat way to test out apps before taking them to the Bitcoin blockchain, but other than that, there is no real purpose to it.

Takeaway

I believe Litecoin will appreciate in the coming months leading up to its halving event. This could be good for a trade, but I would not include Litecoin within my core holdings. 10 years ago, there was a lot to like about Litecoin, but now other cryptocurrencies have caught up with it.