While the Ethereum community prepares for the upcoming Shanghai hard fork in March, the development team for the liquid staking project Lido revealed plans to create an in-protocol withdrawal feature. Lido’s team is seeking community feedback on the proposal that would allow withdrawals after the Shanghai upgrade is completed.

Lido Dominates Defi Economy With $7.9 Billion in Total Value Locked, Team Prepares for Shanghai Withdrawals

As of the time of writing, the decentralized finance (defi) liquid staking protocol Lido is the most dominant defi protocol today, in terms of total value locked (TVL). Statistics from defillama.com show that Lido’s $7.92 billion TVL dominates the $46.56 billion TVL held in defi today by approximately 17.01%.

Lido is the largest holder of staked ethereum as the protocol commands around 29% of the staked ether supply. Lido’s ethereum derivative token STETH is the 13th largest market valuation in the cryptocurrency economy with $7.73 billion. Furthermore, Lido has a governance token called lido dao (LDO), which has a market capitalization of around $1.96 billion on Jan. 25, 2023. The day prior, Lido’s development team published a proposal concerning withdrawals after the Shanghai upgrade.

Ethereum developers are determined to make the Shanghai hard fork happen this March and the main focus is allowing staked withdrawals. “The design proposed by Lido on the Ethereum Protocol Engineering team addresses these challenges with the in-protocol withdrawal requests queue,” the Lido team explains in a summary of the withdrawals landscape via the Lido protocol. “The process has to be asynchronous, due to the asynchronous nature of ethereum withdrawals,” the Lido developers add.

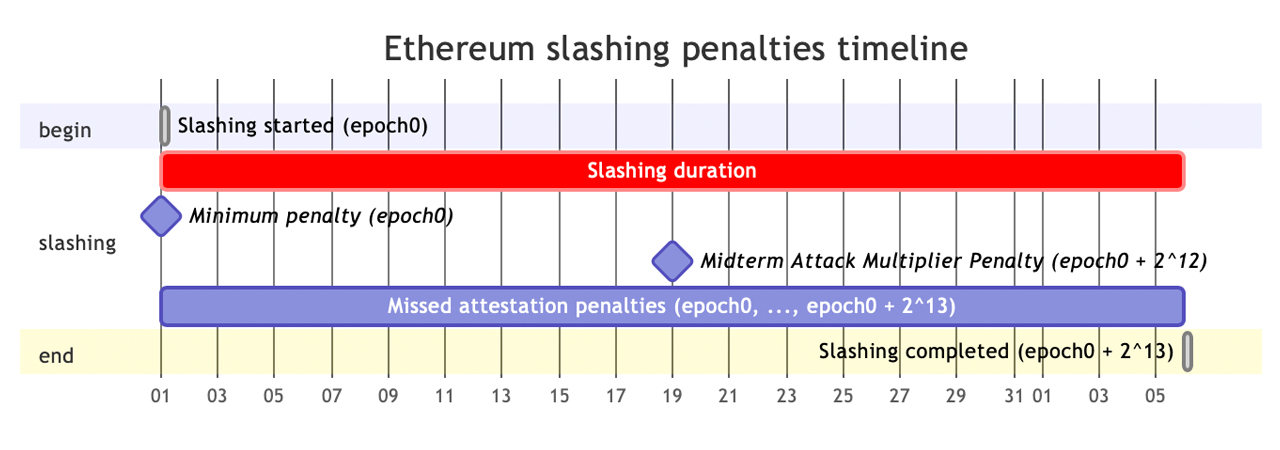

The Lido developers explain there would be various modes of withdrawals including a “turbo” feature and a “bunker” feature. Further penalties and slashing would be codified for validators that break the rules. The summary explains how slashings affect a user’s withdrawal request fulfillment.

“We are seeking the community’s feedback to make sure that our proposal takes all important considerations into account and to identify any potential improvements,” the Lido team details. “Your feedback is invaluable to create a proposal that is effective, efficient, and fair for all stakeholders.”

What are your thoughts on Lido’s proposal for in-protocol withdrawal requests and the upcoming Shanghai hard fork? Do you think this feature will have a significant impact on the crypto and defi market? Share your opinions in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.