Article content

The meltdown of the cryptocurrency exchange FTX cost a handful of celebrities considerable sums of money.

Advertisement 2

Article content

The once high-flying company filed for bankruptcy in November, and its founder and CEO Sam Bankman-Fried (who lost billions himself) is awaiting trial in New York City on fraud charges, to which he has pleaded not guilty. Co-founder Gary Wang reportedly lost nearly $2 billion.

Recently, a 68-page document revealed in court the individuals and investment firms who had the largest shares in the company. At its peak in September of 2021, FTX was valued at $32 billion U.S. At that point, shares were trading at $80.

Of course many more regular investors lost money too, just not as much individually as these people.

THE BIGGEST FTX LOSERS:

Tom Brady and Gisele Bundchen: The NFL legend and his super-model ex-wife starred in commercials for FTX and had a lot of shares.

Advertisement 3

Article content

Brady had 1.1 million common shares of FTX Trading, which were worth about $93 million at the peak, according to the Daily Mail.

Bundchen has more than 680,000 shares and they were worth $57 million at the high.

That said, nobody yet knows if they actually paid anything for the shares or were given them for promoting FTX.

“It’s an incredibly exciting time in the crypto-world and Sam and the revolutionary FTX team continue to open my eyes to the endless possibilities,” Brady said in 2021. “This particular opportunity showed us the importance of educating people about the power of crypto while simultaneously giving back to our communities and planet. We have the chance to create something really special here, and I can’t wait to see what we’re able to do together.”

Advertisement 4

Article content

Brady’s agent, Don Yee, and a spokesman for Robert Kraft did not immediately respond to DailyMail.com’s request for comment.

-

Tom Brady, Shohei Ohtani among biggest losers in FTX collapse

-

FTX: Scandal-ridden crypto bro Sam Bankman-Fried ‘suprisingly optimistic’

-

WARMINGTON: This time it was ‘Shark’ who got bit in billion-dollar crypto tanking of FTX

Robert Kraft: Kraft owns the NFL’s New England Patriots and is a close friend of Brady’s. He has a net worth of over $10 billion, so likely doesn’t care too much that his more than 600,000 shares, which were once valued at $53 million, are now virtually worthless.

Peter Thiel: Another billionaire, Thiel is worth over $7 billion. He founded Paypal and had around 300,000 shares valued at $25 million.

Advertisement 5

Article content

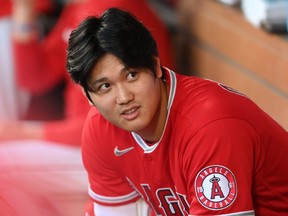

Shohei Ohtani: Ohtani, one of the best players in baseball and a former MVP who both pitches and hits, took a stake as an ambassador in stock, company equity and cryptocurrency. It’s unclear exactly what the collapse cost him.

Other sporting figures like tennis star Naomi Osaka and Jacksonville Jaguars quarterback Trevor Lawrence also had similar deals. Steph Curry, Shaquille O’Neal and television star Larry David also lost out.

Leagues and arenas (like the home of the Miami Heat) have also been impacted by the collapse. The Miami arena will be named Miami-Dade Arena for now instead of FTX Arena.

Closer to home, the Ontario Teachers’ Pension Plan took a sizeable hit. It will write down the entirety of its $95 million investment in FTX, according to reports.

The plan owned 11.9 million shares.