Tevarak

While bitcoin (BTC-USD) remains around 70% below its November 2021 peak, the cryptocurrency still fared better than both stocks and bonds during the third quarter, in a sign that token prices could have stabilized and possibly formed a bottom.

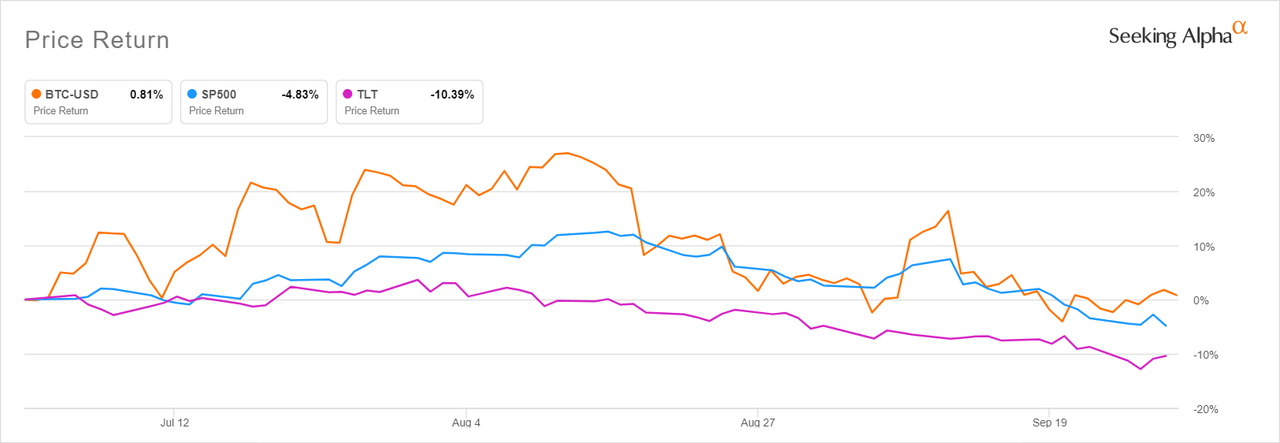

The world’s largest digital token by market cap (BTC-USD) inched up 0.8% in Q3, changing hands at $19.45K as of shortly before 4:30 p.m. ET. That compared with the stock market (SP500), down 4.8%, and bonds (TLT), -10.4%, as seen in the chart below. Bitcoin’s rise was relatively small for such a volatile asset, though it stands out since its correlation with equities has been strong in the past year.

With the exception of a soaring U.S. dollar (Dow Jones FXCM Dollar Index (USDOLLAR) +3.5% in Q3), a broad range of asset classes have been stung by the Federal Reserve’s monetary tightening cycle as well as slower growth projections, stubbornly high inflation and geopolitical tensions.

Since early summer, bitcoin (BTC-USD) has been bouncing around its 2017 bull market top within a thin range of $18.8K-24.1K. Perhaps the token has created a floor as more prominent firms start offering BTC-related products (despite huge drawdowns seen in the beginning of 2022) to customers, thus expanding overall adoption. In August, BlackRock (BLK), the world’s largest asset manager, unveiled a spot bitcoin private trust for its institutional clients, as “we are still seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities.”

Speaking of crypto adoption, Seeking Alpha contributor Gary Bourgeault argued that bitcoin’s (BTC-USD) “future remains bright” given ongoing interest from countries, states and venture capital firms.

“While the drop in price of Bitcoin in 2022 has resulted in slower growth, it still remains far above what it was before the bull market of 2020,” he wrote.

SA contributor The Digital Trend believes bitcoin will thrive no matter what the Fed does.